How to develop your startup's ideal customer profile (ICP)

The first step in finding your best-fit customers is to develop your ideal customer profile (ICP). Here's a step-by-step guide and templates to help you do it.

One of the most critical factors in determining your startup's success is how well you understand and focus on your best-fit customers.

The companies that understand their customers better are the companies that know how to win. Why? Because your customers will tell you how to win if you ask them.

They'll tell you what to build, what to say, where to say it, what they value, and how much they're willing to pay.

But not every customer is created equal. Some customers are a better fit than others.

☝️ This is where many startups get tripped up.

Different types of customers begin to buy your solution.

But different customer types have different needs.

They value different things.

They ask for different features.

They search for solutions in different places.

They are willing to pay different amounts.

Before long, your startup is trying to build ten solutions and ten go-to-market strategies for ten different types of customers. That's a recipe for disaster.

The key to winning in a startup is understanding and focusing 100% of your effort on your best-fit customers (and only your best-fit customers).

But how do you do that?

For B2B companies, there are two main tools to help you better understand your best-fit customers:

Ideal customer profile (ICP): The company attributes of your best-fit customers.

Buyer personas: The people who participate in the sales process at your ICP companies.

In this post, I'll teach you how to create an ideal customer profile (ICP). In part two, in a future post, I'll dive deeper into how to create buyer personas.

But first an ICP caveat…

Most B2B startups don't prioritize ICP work as much as they should. Why? Because most see it as a static (one-time) activity rather than a dynamic (ongoing) activity.

And they don't want to spend time on something that will quickly become outdated. (Which makes sense.)

But that is a mistake.

Check out what SaaS growth expert Lincoln Murphy said about this:

“Determining your Ideal Customer is NOT about determining the ONLY type of customer you’ll ever do business with. No, it’s about determining the Ideal Customer for a particular situation.” — Lincoln Murphy

Your ICP should change and evolve as your company grows. As a brand-new startup, your ICP might change weekly. But for most, it will change at least every 3-6 months.

So let go of the FOMO you may feel when doing this work.

The takeaway: Don't write this off as "useless, fluffy marketing work that quickly gets stale" as some founders do. Keeping your teams aligned as your company grows should be an ongoing, high-priority activity.

Okay, I'll get off my soap box. Now on to how to develop your ICP.

Step 1: Build a list of your top 10 best-fit customers

One of our largest customers at a previous company paid us nearly $100k/year for three years. But they never used our product once.

They were not one of our best-fit customers.

Deal size is an essential factor, but your best-fit customers aren't always the ones who pay you the most.

What criteria should you use to determine your “best-fit” customers?

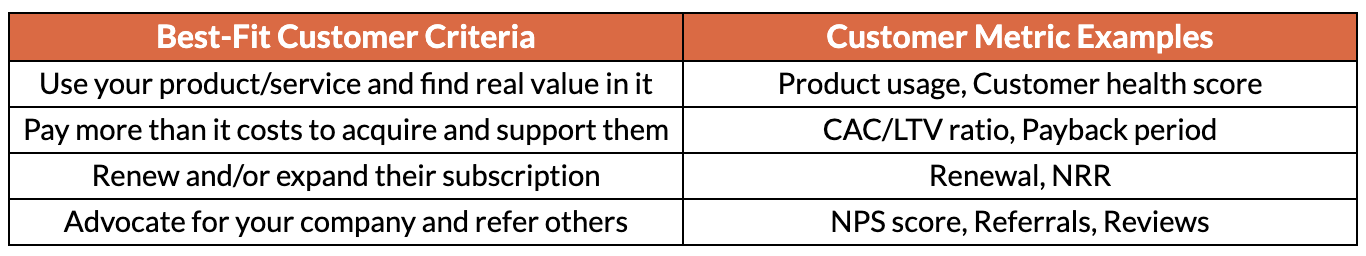

Best-fit customers are those that do all four of these things:

Use your product/service and find real value (most important!)

Pay more than it costs to acquire and support them

Renew or expand their subscription

Advocate for your company and refer other best-fit customers

The fastest and easiest way to find your best-fit customers is to ask everyone on your GTM team (e.g., sales, marketing, customer success) to come up with a list of 5-10 existing customers they believe best fit these four criteria. Combine the lists and prioritize the customers that are mentioned most often.

For most early-stage startups, this is sufficient.

But this is more of a qualitative than quantitative approach. This approach is faster, but some founders will insist it needs to be backed up with data even if it takes longer.

To validate each best-fit company in your list with data, find a customer metric that aligns with each best-fit customer criteria. Here's an example:

By comparing these metrics for your best-fit customers with the average or median of all customers, you should be able to validate whether each best-fit customer belongs on your list quantitatively.

But what if you don't have ANY customers that align with your best-fit customer criteria?

If true, you're still searching for product/market fit.

Pick a customer segment with the best potential to become your best-fit customers and build your ICP around those companies.

As you focus on that ICP, you'll soon learn whether you picked right or wrong. If wrong, update your ICP to a new segment and keep trying.

This is what finding product/market fit is all about.

Yet, many founders fail to see their ICP as their primary tool to help them do that. Don't be one of those founders.

Note: Ten is an arbitrary number for creating a list of best-fit customers. You're welcome to expand or contract that number to fit your needs. You'll want enough companies to start to see patterns (which often you can begin to do with about ten companies), but not too many that your definition of "best fit" gets too broad.

Step 2: Define key attributes for each best-fit customer in your list

Now that you have a list of 10 best-fit companies, the next step is identifying and collecting each company's attributes.

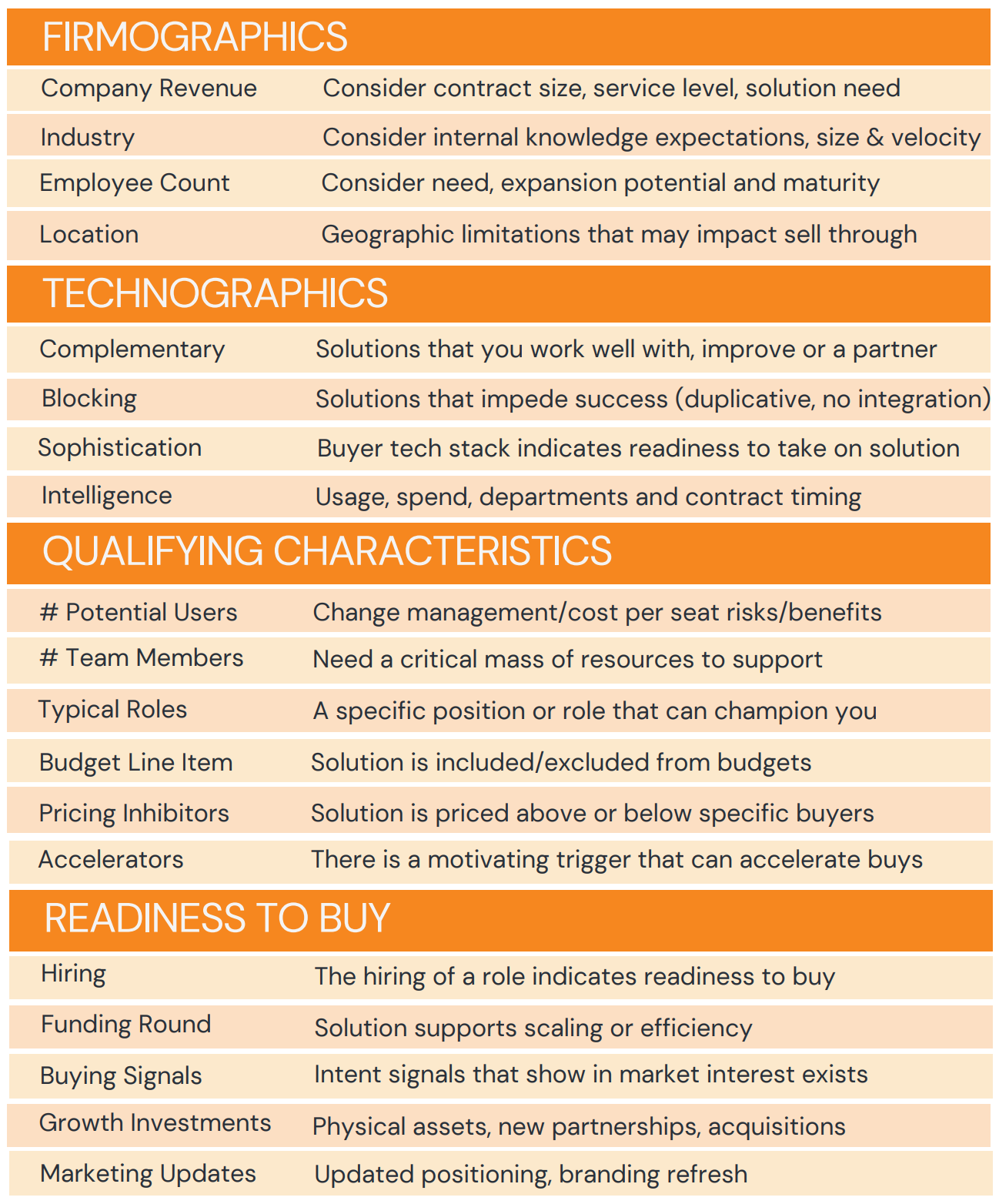

Examples of company attribute types include firmographics, technographics, qualifying characteristics, and readiness to buy signals.

Here's a list of some common ICP attributes to consider:

The attributes you collect depend on your product/service and GTM motion.

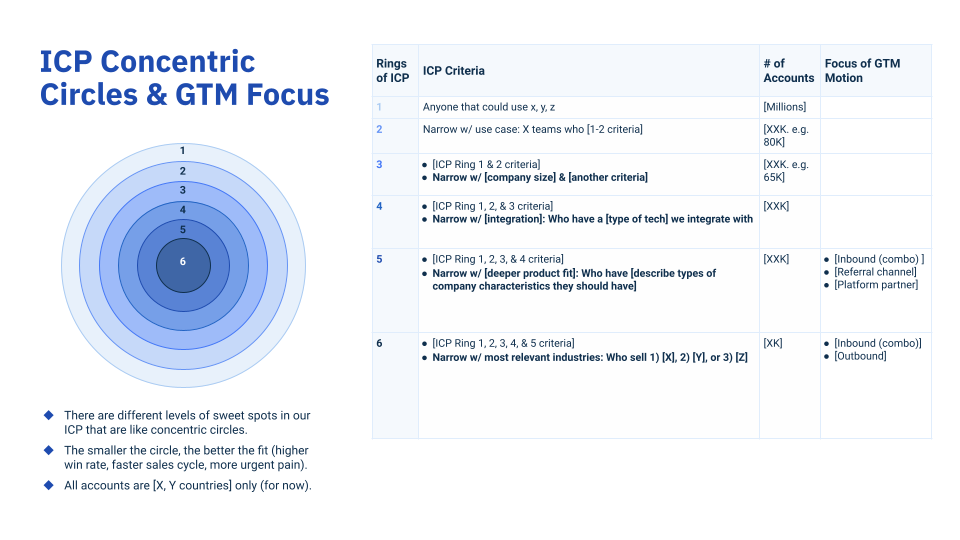

The goal is to find the 4-5 attributes that help you hone in on your best-fit customers. Each trait should move you closer to the center bullseye of your target customers.

Check out this example from Grant Duncan that I think illustrates this:

When just starting, I recommend focusing on gathering the following company attributes for each company in your list:

Three core firmographics

Industry

Location

Company size (Usually revenue or employee count)

1-2 qualifying characteristics (or technographics)

For Lavender.ai, an email copywriting tool for sellers, one of the qualifying characteristics is probably companies with an outbound sales motion.

For Vark.io, an SMS app in the HubSpot marketplace, one of the qualifying characteristics is probably companies that use HubSpot.

One readiness to buy signal

For Lavender.ai, a readiness to buy signal might be when a company hires its first sales rep or head of sales.

For Vark.io, a readiness to buy signal might be when a customer buys HubSpot Sales Hub.

(Optional) 1-4 best-fit customer metrics

Add the 1-4 customer metrics from step 1. (Ex. Product usage, Customer health score, CAC/LTV ratio, Payback period, Renewal, NRR, NPS score, Referrals, Reviews, etc.)

The key is to keep this simple by initially limiting the number of attributes you collect. If you're unsure whether an attribute should be included, remove it. You can always add more later if needed.

Step 3: Review the data and look for patterns

After collecting ICP attributes for each of your best-fit companies, look for patterns and outliers.

You aim to identify 1-2 common segments across your best-fit customers.

Often for B2B companies, a segment = a combination of industry + company size.

But for verticalized software/services, use cases or other attributes could be a factor in determining segments.

For example, when I did this activity last week with a client, there was a clear pattern among their best-fit customers of mid-sized manufacturing companies with 1k-5k employees.

We also chose to ignore a few outliers in obscure industries for their ICP.

What if you need help picking which segment to focus on?

As mentioned previously, the key to developing a strong ICP is focus. The more segments/industries/use cases you have in your ICP, the weaker it gets.

That is why I always recommend picking only 1 or 2 segments to include in your ICP.

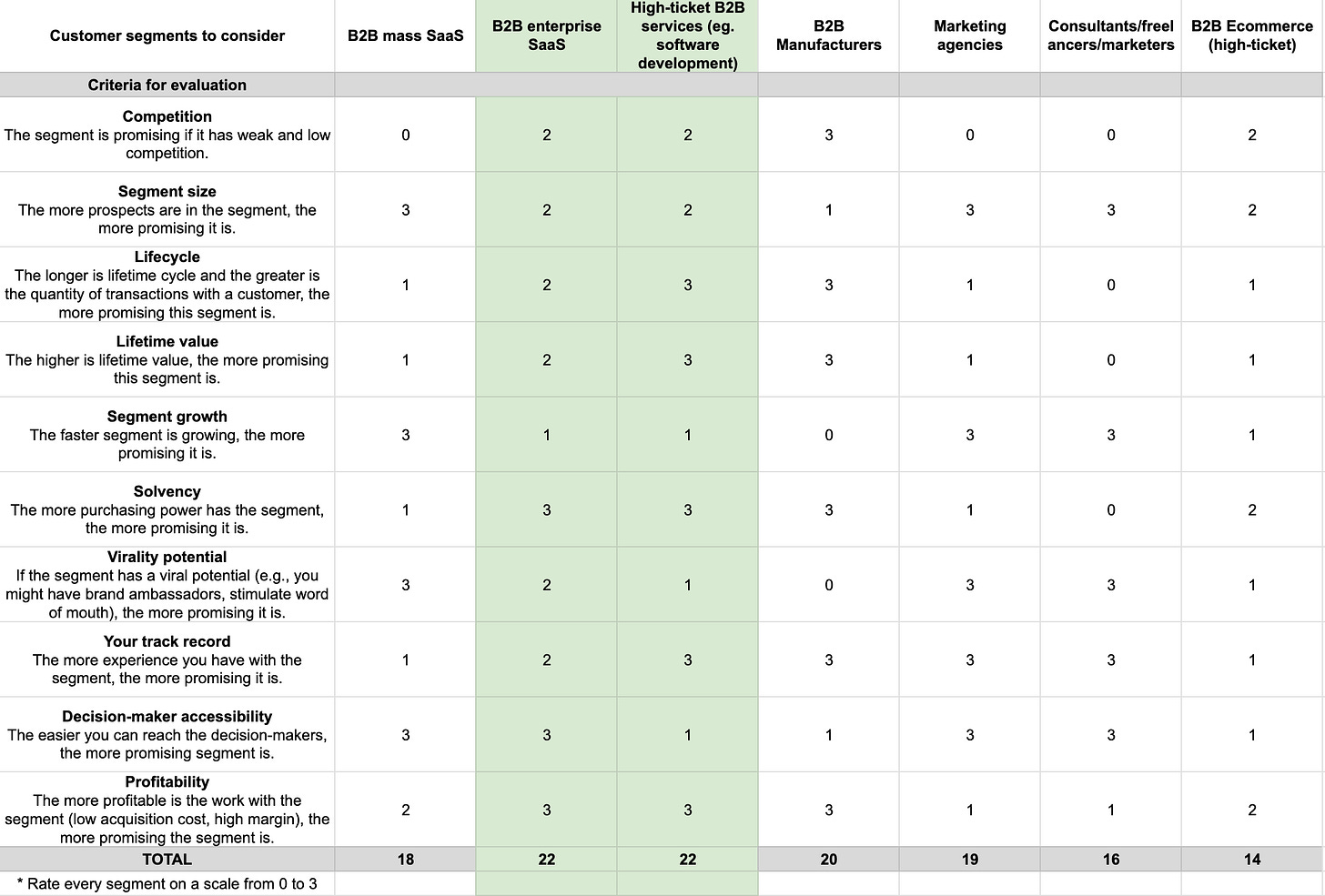

But what if you have more than two segments and need help deciding which to focus on?

If that is the case, it helps to score your different segments based on specific "segment health criteria" to help you decide. Here is an example:

As you can see in the example, we scored each segment based on ten factors. We then summed the scores for each segment to identify the top two.

Here is a link to a Market Segmentation Template in Google Sheets to help you evaluate your market segments. Feel free to make your copy to use.

Step 4: Build your ICP based on your findings

Now that you've identified which segments to focus on, the next step is to create your ICP based on the company "averages" for each segment.

This step is as simple as it sounds.

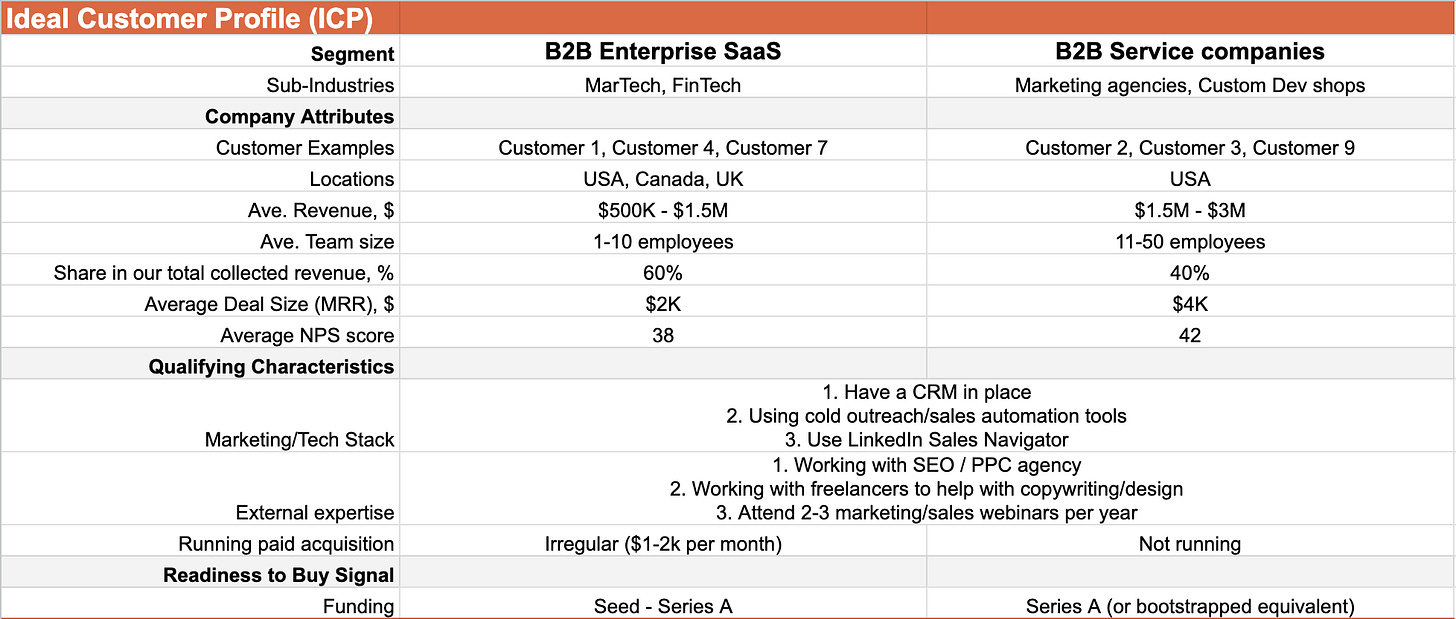

Here's an example of what the final output might look like:

This document will be your source of truth for your best-fit customers.

Ensure this is shared with your entire GTM team and revisited and updated regularly as your team learns and sells more.

Bonus Step: Compare your new ICP to your existing customer base

The last thing I recommend is comparing your new ICP to the rest of your customers, which can help you understand what is at stake and how to successfully transition to focusing on your new ICP.

Here is an example of what that might look like:

Conclusion

Your ideal customer profile (ICP) is one of your best tools to help you understand and align your team around your best-fit customers.

Stay tuned for part two, where I'll dive deeper into the other tool to help you with this: Buyer personas.

ICP Templates

In case you missed them, here are the links to the two templates to help you with this process. Feel free to reach out if you have any questions about how to use these.

ICP + Buyer Personas Template

Market Segmentation Template

This is a goldmine, Garrett. I'll also keep revisiting :)

So good! Reread “the 4 things best-fit customers do” several times. Definitely will be revisiting